goyard france tax refund | Goyard in Paris cost goyard france tax refund VAT (Tax) Refund Information. The VAT refund will depend on whether you want it back in cash (euros) or back on your credit card. I’ve chosen credit cards every time thinking that I’m obviously going to get more money . Compared to an authentic belt, the “LV” buckle on a fake is often rounded, not straight, not as sharply or finely cut, and too thick or thin. [1] Look at the buckle’s color, too. The “LV” logo might be duller than a real “LV” logo and the hue may look off. For instance, a fake gold “LV” logo might be too brassy.

0 · chanel Goyard vat refund

1 · buy Goyard in paris

2 · Goyard st thomas wallets

3 · Goyard paris wallet

4 · Goyard paris wait times

5 · Goyard paris online shopping

6 · Goyard locations in paris

7 · Goyard in Paris cost

Harga LV INITIALES MATTE BLACK 40mm Men's Belt M0449: Rp 15.592.520: Harga LOUIS VUITTON Men's Presbyopia Long Folding Zipper Wallet M61697: Rp 55.703.280: Harga Louis Vuitton Speedy 30 BA.NM Damier Azur N41373: Rp 60.999.000: Harga Louis Vuitton Neo Noe MM MNG Coquelicot Red M44021: Rp 61.999.000: Harga Louis Vuitton .

In France, there’s two major companies that processes VAT refunds for retailers: Global Blue and Planet Tax Free (formally Premier Tax Free). In my experience, Global Blue is pretty fast and I get my VAT refund back within a couple of days. VAT (Tax) Refund Information. The VAT refund will depend on whether you want it back in cash (euros) or back on your credit card. I’ve chosen credit cards every time thinking that I’m obviously going to get more money . The amount does not consider the USA sales tax and Paris VAT Refund. The VAT refund in Paris is usually around 12% ( technically 10-11% ) so you will actually be saving even . Step-by-Step Guide to Receive a VAT Refund in-Store. The procedure of requesting a VAT refund may appear overwhelming at first. This step-by-step guidance is intended to simplify the procedure and ensure that .

As a visitor to France, you may be eligible to buy goods tax-free and get a refund on the Value Added Tax (VAT) you paid during your stay. This guide will walk you through the process of obtaining a VAT refund step by .

How Much: 19.6% if processed by the shopper; usually 12% if processed in-store via a refund agency, which takes a cut for itself. Who: Residents of non-EU countries over the age of 16, visiting France on a tourist .

There are two main ways you can get a tax refund form – using the traditional, in-store paper method, or a digital app like Wevat. Using the traditional method, you’ll need to show your passport to the sales assistant, . What qualifies for a refund? Almost all luxury goods—including clothes, shoes, cosmetics and skincare, jewelry, handbags, leather goods, and art—will have a value-added tax. Many items qualify for a VAT refund, but it’s .

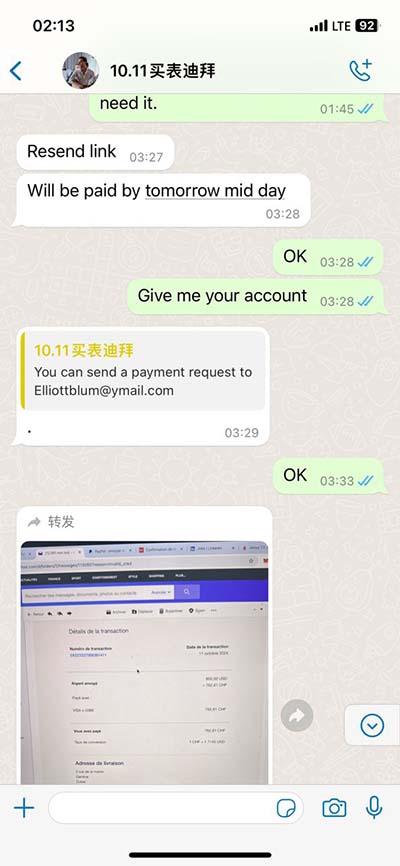

The price of my bag in France was €1040 (roughly €866 + 20% VAT of €174) compared to 85 USD (60 retail price plus 8% California sales tax of 5.44). The amount claimed on the VAT refund is €174 but there is a . In France, there’s two major companies that processes VAT refunds for retailers: Global Blue and Planet Tax Free (formally Premier Tax Free). In my experience, Global Blue is pretty fast and I get my VAT refund back within a couple of days. VAT (Tax) Refund Information. The VAT refund will depend on whether you want it back in cash (euros) or back on your credit card. I’ve chosen credit cards every time thinking that I’m obviously going to get more money back so why would I do cash.

Simple Steps for Receiving VAT Tax Refund. Go Shopping! Spend over €100.01 in a Single Store or Department Store; Request an Invoice. Request a VAT Tax Refund Document; Make sure you bring your passport; Scan your Paperwork Before Leaving France/ EU. Submit your tax refund paperwork at the airport or train station The amount does not consider the USA sales tax and Paris VAT Refund. The VAT refund in Paris is usually around 12% ( technically 10-11% ) so you will actually be saving even more than what I’ve posted. Step-by-Step Guide to Receive a VAT Refund in-Store. The procedure of requesting a VAT refund may appear overwhelming at first. This step-by-step guidance is intended to simplify the procedure and ensure that you can recover VAT on qualified purchases promptly. Step 1. Spend More than €100 in VAT-Refund Eligible Stores. As a visitor to France, you may be eligible to buy goods tax-free and get a refund on the Value Added Tax (VAT) you paid during your stay. This guide will walk you through the process of obtaining a VAT refund step by step, making your shopping experience in France even more enjoyable (cheaper).

How Much: 19.6% if processed by the shopper; usually 12% if processed in-store via a refund agency, which takes a cut for itself. Who: Residents of non-EU countries over the age of 16, visiting France on a tourist visa. There are two main ways you can get a tax refund form – using the traditional, in-store paper method, or a digital app like Wevat. Using the traditional method, you’ll need to show your passport to the sales assistant, ask for a refund .

What qualifies for a refund? Almost all luxury goods—including clothes, shoes, cosmetics and skincare, jewelry, handbags, leather goods, and art—will have a value-added tax. Many items qualify for a VAT refund, but it’s important to note that .

The price of my bag in France was €1040 (roughly €866 + 20% VAT of €174) compared to 85 USD (60 retail price plus 8% California sales tax of 5.44). The amount claimed on the VAT refund is €174 but there is a processing fee so I received €124 as a refund.

In France, there’s two major companies that processes VAT refunds for retailers: Global Blue and Planet Tax Free (formally Premier Tax Free). In my experience, Global Blue is pretty fast and I get my VAT refund back within a couple of days. VAT (Tax) Refund Information. The VAT refund will depend on whether you want it back in cash (euros) or back on your credit card. I’ve chosen credit cards every time thinking that I’m obviously going to get more money back so why would I do cash.

dior careers paris

Simple Steps for Receiving VAT Tax Refund. Go Shopping! Spend over €100.01 in a Single Store or Department Store; Request an Invoice. Request a VAT Tax Refund Document; Make sure you bring your passport; Scan your Paperwork Before Leaving France/ EU. Submit your tax refund paperwork at the airport or train station The amount does not consider the USA sales tax and Paris VAT Refund. The VAT refund in Paris is usually around 12% ( technically 10-11% ) so you will actually be saving even more than what I’ve posted.

Step-by-Step Guide to Receive a VAT Refund in-Store. The procedure of requesting a VAT refund may appear overwhelming at first. This step-by-step guidance is intended to simplify the procedure and ensure that you can recover VAT on qualified purchases promptly. Step 1. Spend More than €100 in VAT-Refund Eligible Stores. As a visitor to France, you may be eligible to buy goods tax-free and get a refund on the Value Added Tax (VAT) you paid during your stay. This guide will walk you through the process of obtaining a VAT refund step by step, making your shopping experience in France even more enjoyable (cheaper). How Much: 19.6% if processed by the shopper; usually 12% if processed in-store via a refund agency, which takes a cut for itself. Who: Residents of non-EU countries over the age of 16, visiting France on a tourist visa. There are two main ways you can get a tax refund form – using the traditional, in-store paper method, or a digital app like Wevat. Using the traditional method, you’ll need to show your passport to the sales assistant, ask for a refund .

What qualifies for a refund? Almost all luxury goods—including clothes, shoes, cosmetics and skincare, jewelry, handbags, leather goods, and art—will have a value-added tax. Many items qualify for a VAT refund, but it’s important to note that .

chanel Goyard vat refund

dior capture youth age-delay advanced creme review

dior catsuit

dior capture youth glow booster age delay illuminating serum

dior couture logo

There are four main things to observe for the buckle when deciding whether you have a fake Louis belt or not: how it feels, how it looks, where it’s located, and the color of the hardware. Counterfeit belts often are too thin, too thick, or have inconsistencies—which should immediately alert you to a fake.

goyard france tax refund|Goyard in Paris cost